As seen in Colorado Real Estate Journal>>

Written by: Kevin Brinkman, Co-Founder & CEO, Brinkman Real Estate

Over the past several years, the multifamily housing market has demonstrated a remarkable ability to absorb unprecedented levels of new supply. Even as the industry experienced the highest construction surge since the 1980s, demand proved stronger than anticipated, stabilizing occupancy and supporting a positive rent growth outlook heading into 2025 and beyond.

At the national level, while new deliveries peaked at historic levels in late 2024 and early 2025, reaching more than double the average annual rate from 2015 to 2019, occupancy remained relatively stable at 94.4% (Freddie Mac, 2025). Rent growth was modest but positive, and most importantly, the market demonstrated resilience even amid high interest rates, inflationary pressures, and economic uncertainty. According to RealPage data, annual multifamily demand topped 490,000 units in 2024, one of the highest figures on record outside the immediate post-pandemic boom (Freddie Mac, 2025).

While national fundamentals are encouraging, the mountain west and desert regions stand out as exceptionally resilient. Markets like Colorado Springs, Salt Lake City, Las Vegas, and Boise absorbed their recent influx of new supply much faster than initially forecasted, setting the stage for strong performance in the years ahead.

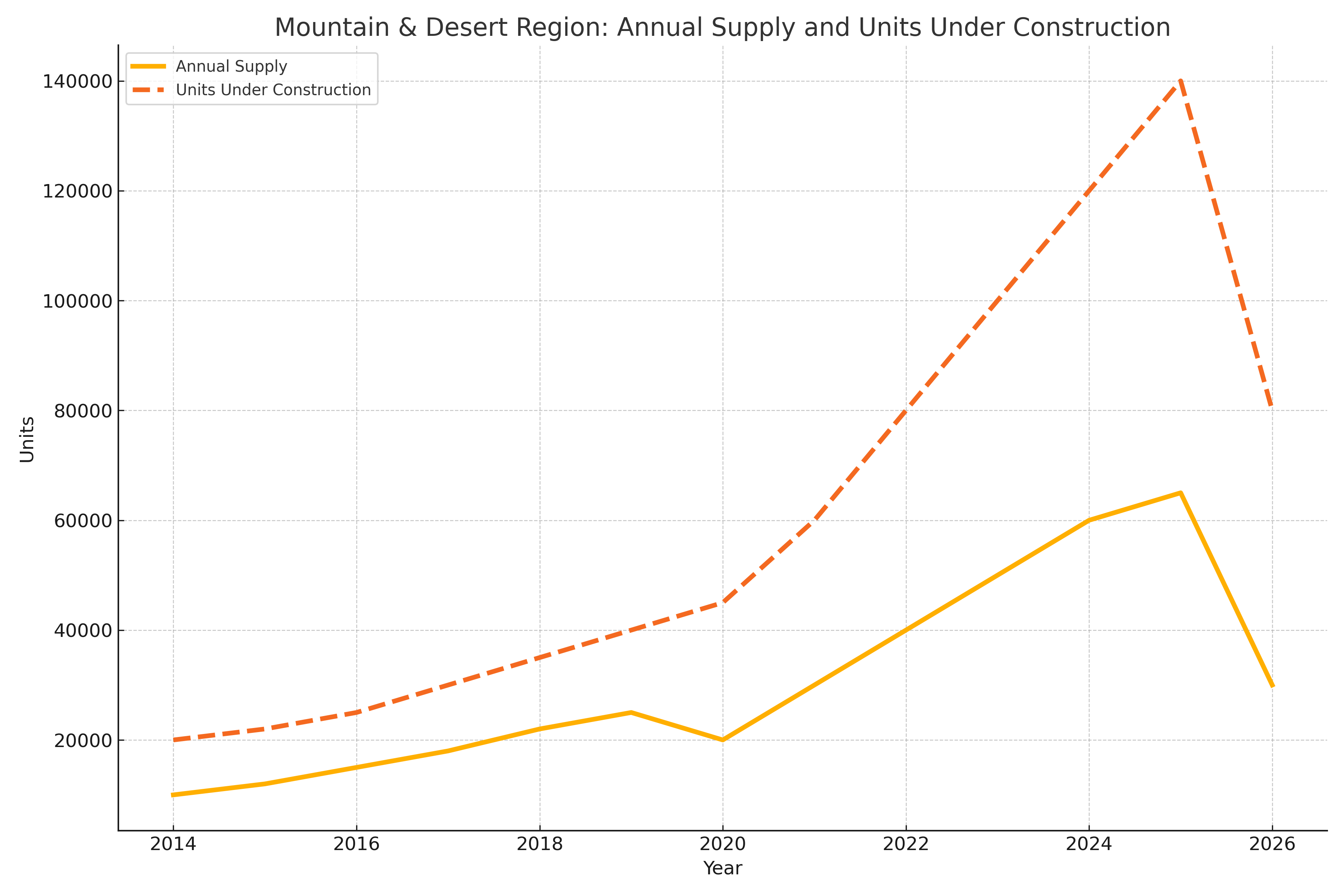

Chart 1: Mountain & Desert Region Annual Supply vs. Units Under Construction

(RealPage, 2025)

Annual multifamily supply peaked in early 2025, but new construction starts are now declining sharply, supporting occupancy stability.

Annual multifamily supply peaked in early 2025, but new construction starts are now declining sharply, supporting occupancy stability.

In the mountain and desert states, annual supply reached its peak in early 2025, tripling the delivery volume from just a few years prior (RealPage, 2025). However, construction pipelines are shrinking rapidly, with units under construction already declining significantly. This supply moderation, combined with enduring population and employment growth, points toward a tightening market and renewed pricing power for landlords.

Occupancy in the region held strong even at the peak of new deliveries. As of Q1 2025, regional occupancy averaged 95% or higher in several of our target markets, including Boise (95.2%), Fort Collins (95.2%), and Greeley (95.8%) (RealPage, 2025). In larger markets like Las Vegas and Salt Lake City, occupancy rates have stabilized near 94%–95% even with notable supply growth, highlighting the depth of renter demand.

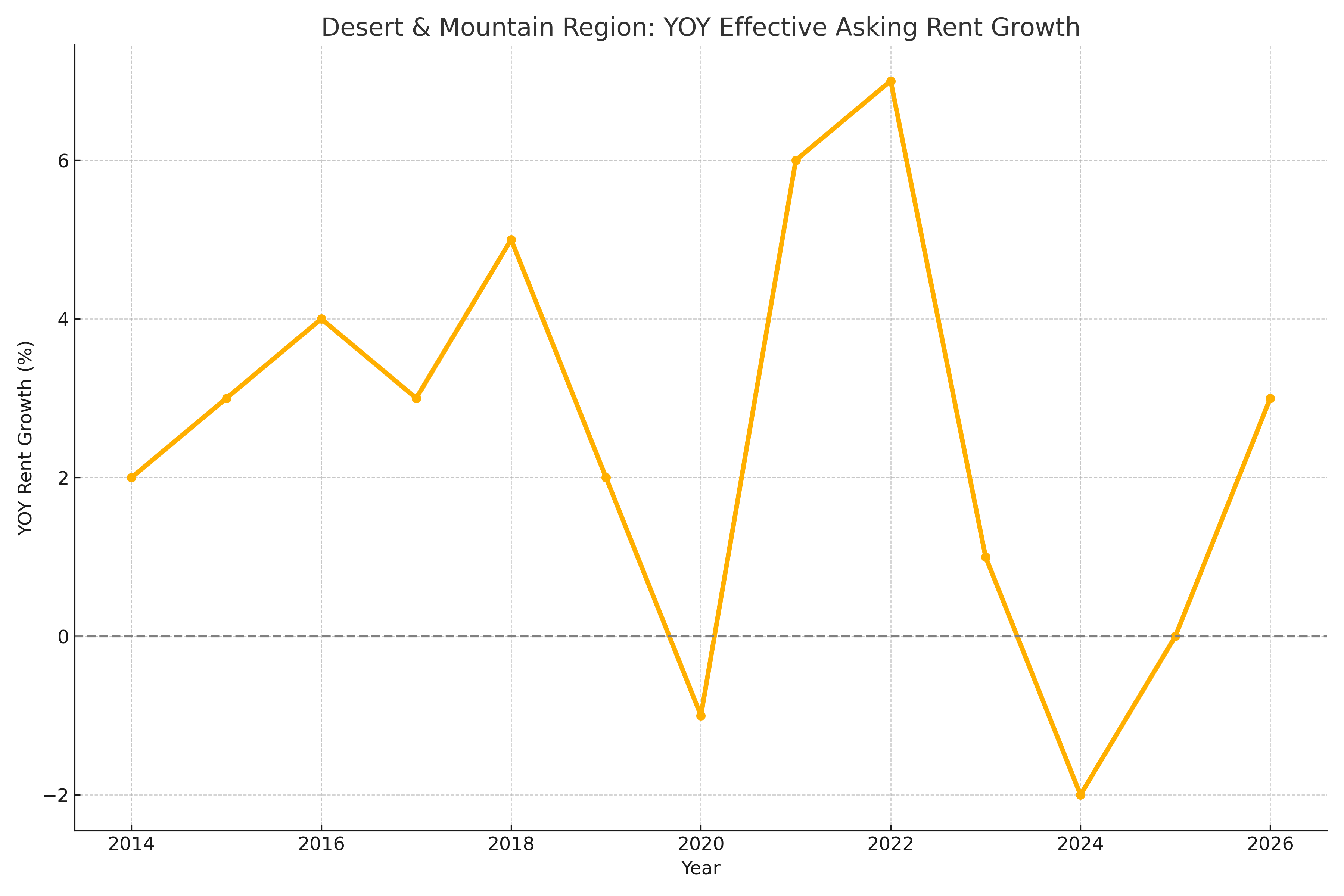

Chart 2: Year-Over-Year Effective Rent Growth, Desert & Mountain Region

(RealPage, 2025)

Following a short-term dip during peak supply years, rent growth is poised to rebound in 2025–2026 as new deliveries wane and demand remains robust.

After a period of flat or slightly negative rent growth tied to peak supply absorption, RealPage forecasts a return to positive rent growth in the mountain and desert regions beginning in late 2025. Year-over-year rent growth is already showing signs of inflection, with asking rents stabilizing in early 2025 and forecasted to accelerate through 2026 and beyond.

This regional performance reflects broader demographic and economic trends. Migration into the mountain west remains strong, driven by affordability, quality of life, and robust employment bases. Cities like Denver, Salt Lake City, and Boise continue to attract young professionals and families priced out of coastal markets. Meanwhile, the high cost of homeownership—exacerbated by elevated mortgage rates—keeps many would-be buyers renting longer. According to Freddie Mac, the monthly cost to finance a home remains nearly twice the cost of renting in many metros, reinforcing rental demand (Freddie Mac, 2025).

Additionally, new construction challenges, including material costs, labor shortages, and financing headwinds, are expected to limit future multifamily starts. Tariff policies and broader economic uncertainty are likely to keep construction subdued through 2026 (Marcus & Millichap, 2025). As a result, the risk of future oversupply is minimal compared to the surge we just successfully absorbed.

Even with some markets facing near-term volatility, the overall fundamentals remain attractive for investors willing to focus on quality assets and high-growth regions. Investment capital continues to seek multifamily real estate as a durable asset class amid volatility in equity and bond markets. Freddie Mac forecasts transaction volume to rise to $370–$380 billion in 2025 as capital markets stabilize and the market recognizes the sector’s strong underlying demand (Freddie Mac, 2025).

At Brinkman Real Estate, we’re optimistic about the years ahead. We’re targeting opportunities in mountain west markets where demand drivers are resilient, future new supply is significantly reduced, and the renter demographic remains strong. In our view, the strategic patience displayed during the current supply surge will reward investors as we transition into the next growth cycle.

In short, the multifamily market proved its strength when it mattered most. And in the mountain states, the outlook is brighter than ever.

References

Freddie Mac. (2025). 2025 Multifamily Outlook. https://mf.freddiemac.com/research.

Marcus & Millichap. (2025). U.S. Trade Policy Special Report. https://www.marcusmillichap.com/research/special-report/2025/04/25_04_us-trade-policy-special-report.

RealPage. (2025). Desert & Mountain Region Market Intelligence Update Q1 2025. https://www.realpage.com/webcasts/market-intelligence-desert-mountain-update-q1-2025/.

RealPage. (2025). Most Apartment Markets Still Below Pre-Pandemic Occupancy. https://www.realpage.com/analytics/occupancy-by-market-2025/.

RealPage. (2025). Why is 2025 Likely to Have Strong Apartment Demand if Job Growth Has Slowed? https://www.realpage.com/analytics/2025-demand-drivers-forecast/.

Contact

Kevin Brinkman, Founder & CEO

Brinkman Real Estate

kevin.brinkman@brinkmanre.com

Kevin-Brinkman.com

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.