The Crystal Ball of Real Estate: Expert Predictions on Interest Rates

As seen in Western Real Estate Business Journal>>

Written by: Kevin Brinkman, Co-Founder & CEO, Brinkman Real Estate

The direction of interest rates in the short-, mid-, and long-term is a hotly debated topic in the commercial real estate sector. I’ve asked every guest we’ve had on our podcast, The Brinkman Report (www.thebrinkmanreport.com), for their predictions and they’ve been somewhat divided. This divergence in perspectives is shaped by a complex interplay of economic indicators, geopolitical factors, and central bank policies, each with significant implications for commercial real estate investments.

A Consensus on Cuts

Every guest I’ve spoken to has agreed with the majority view that we will see some amount of rate cuts this year, although the number of cuts has been mixed. Most analysts see the most-likely scenario playing out as an elongated decline and central banks adopting a wait-and-see strategy, making gradual adjustments based on incoming economic data.

With more unpredictable factors than we’ve ever seen before (e.g. an assassination attempt on the Republican nominee and the withdrawal of the Democratic nominee) the Fed is monitoring a wide range of economic indicators and will respond to evolving conditions rather than committing to a fixed trajectory.

This approach allows for fine-tuning, reducing the likelihood of policy missteps that could trigger economic instability, further supporting the “no landing” economic scenario many analysts have predicted. This will mean continued progress for commercial real estate, injecting some amount of predictability for sellers and investors. In this scenario, the commercial real estate market would turn back on with transaction volume ramping up markedly this year and next. We’d see investors get more comfortable stepping back into the game, the flywheel spinning again, and property values increasing. We, of course, believe it would be a mistake to wait until this “all-clear” signal reverberates through the market and we’ve already begun actively investing in select markets in the mountain states.

The Contrarian Case

A contrarian view comes from a small segment of the financial community who believe that medium to long-term rates will drop initially, but looking out 12- to 18-months, rates will actually be higher than they are today. Our recent podcast guest, Joe Hegener, managing director of Asterozoa Capital, takes this viewpoint. He noted in our interview that we may be looking at inflationary pressures again a year from now. Unprecedented national debt, global economic conditions, and an array of other factors point to the long end of the yield curve going up. With a change in the administration comes the risk of potential tariffs that could trigger inflation again. The treasury market would likely start to price in these policies well before they are put into place and we could be back in a position similar to 2023 with yields rising again.

Even this scenario, however, won’t scare off savvy investors who will capitalize on the short-term reduction and seek out distressed assets as we hit the wall of maturities. Firms that can be nimble and creative will see more opportunities on the buying side and focus on finding the right strategy per deal, from locking in short-term debt, to revisiting bank debt, assuming loans, and leaning on strong capital markets relationships to navigate the potential uncertainty.

Developing a Dynamic Strategy

Last month’s podcast guest was an expert on interest rate hedging, Carol Ng with Derivative Logic. She broke down her strategy for forecasting rates for her clients and it came down to three main tactics: following momentum trading, tracking headlines, and studying real-time employment data. While she starts with the technical indicators and working with experts like Hegener who are deep in the details, she also looks at headlines separate from actual data that can provide a pretty clear picture of what the market will do. When it comes to employment data, she mentions that the initial numbers that are announced can often change, so knowing where to look to find the most real-time data is critical to her strategy.

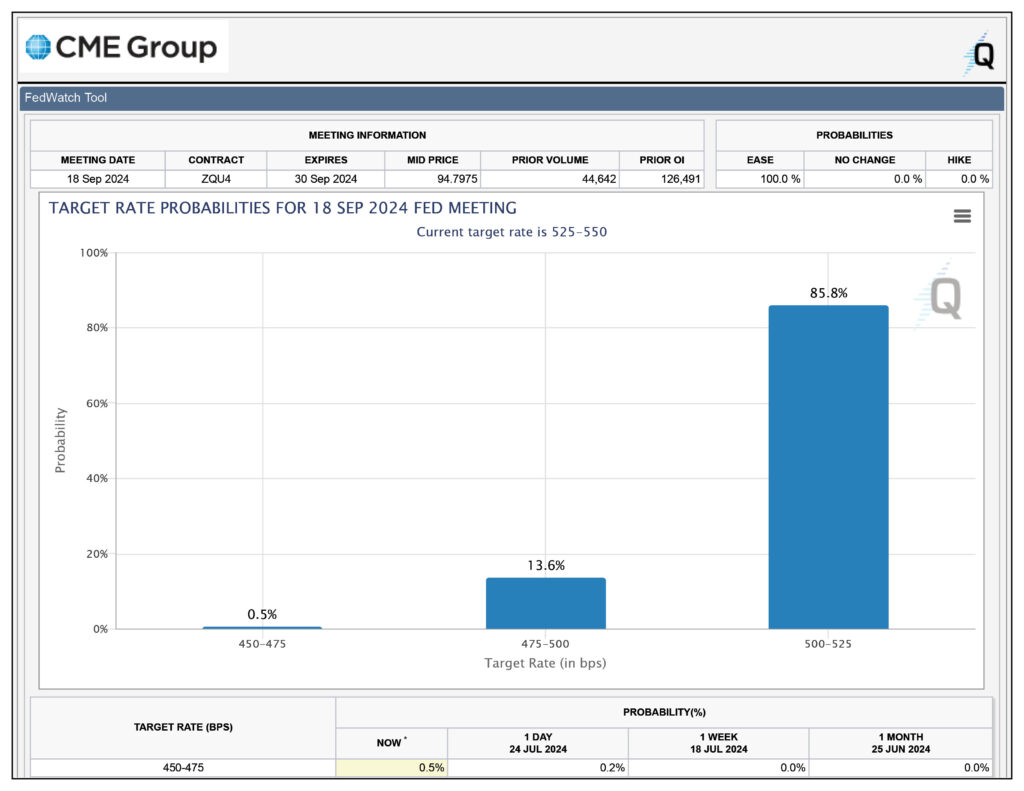

So where do I stand? I’m betting on the Fed dropping rates 50 basis points this year and stabilizing at a reduction of 200 basis points for the mid-term. We’ve already seen an increase in acquisition activity and see no signs of a U-turn anytime soon. While we’re not completely out of the woods, we’re certainly headed in the right direction. A drop in interest rates of 50-75 bps is what will officially turn around the multifamily market. Cap rates may go up slightly but that amount of rate reduction will be enough for investors to get into a positive financial leverage situation, making more deals work for buyers so transaction activity will substantially pick up. This FedWatch tool from CME group is a great resource for the latest probabilities of future rate changes: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html. Currently, there’s a high probability that the September meeting will be the beginning of the next rate-cutting cycle that we’ve all been waiting for.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

With valid arguments on both sides of the interest rate debate, the financial sector remains divided. Whether rates will rise, fall, or remain stable will depend on a multitude of factors, each one increasingly difficult to predict. Economic drivers, geopolitical developments, global conflicts, and more are ever evolving. The ability to adapt quickly to changing conditions and have the capital to deploy as deals hit the market will be key to navigating the challenges and seizing the opportunities. For now, I’m putting my money on the commercial real estate industry celebrating the beginning of the interest rate easing cycle in Q4 of 2024.

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

April 30, 2025

The Brinkman Report – Episode 12

April 17, 2025

New Listening Bar Concept Opens at The Exchange

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.