In the first quarter of this year, CEO of JPMorgan Chase Jamie Dimon coined the term, Goldilocks Moment to describe the current market environment. Why Goldilocks, you ask? Remember the porridge, chair, and bed that were just right? Similarly, Dimon’s outlook coming out of the pandemic recession was that we would see fast and sustained growth with inflation and interest rates rising only gently, just the right amount to maintain a healthy economy.

The drivers behind the Goldilocks Moment included a broad range of factors. In the first quarter of 2021, the vaccine was just beginning to become readily available. The expected successful roll-out pointed to optimism that our world would start to open, and we’d begin to see operations across business sectors approach normalcy. We also saw households and corporate savings reach an all-time high due to several factors, but primarily due to the influx of government spending into the economy. Historically low interest rates supported by continued quantitative easing also helped to stabilize the economy at a much faster rate than we’d normally see coming out of a recession.

As we close out the year, these predictions have largely materialized and provide a continued positive outlook for the economy, especially real estate. GDP surpassed pre-pandemic levels back in Q4 2020 and continued to increase at an annual rate indicative of economic recovery and reopening of businesses (6.3% in Q1, 6.7% in Q2). While the Delta variant of the novel coronavirus sent a surge in the infected numbers this summer, it didn’t curtail consumer spending the same way the first waves of the virus did in 2020. Savings have remained high with an excess of nearly one trillion going into Q4, as well as personal income approaching pre-pandemic levels. Spending appears to have normalized to traditional long-term trends, growing at a normal rate over the course of the year. With the one trillion-dollar infrastructure bill expected to pass by the end of the year and an additional two to three-and-a-half trillion dollars from the Build Back Better Act, these trends are expected to continue in the right direction.

As we end 2021 and look toward 2022 armed with this data, the outlook for real estate investors is strong. However, like the Goldilocks story, we must choose just right and consider the fundamentals of real estate: selecting the right asset class, in the right market, at the right time.

Construction and housing costs continue to point to multifamily as an appreciating asset class for investors. The supply chain difficulties for key construction materials look to continue through 2022 thus making new construction less attainable. Coupled with construction costs, home values continue to increase at an unattainable rate. On average, United States home values have increased more than 17% since last year and are expected to rise nearly 12% in the next year. Those numbers become even more apparent in smaller communities as the de-urbanization trend continues and people migrate out of larger cities into quality-of-life focused places, specifically the Intermountain West Region.

Together, these factors lead to a lack of affordability for prospective homeowners and the need for rental supply.

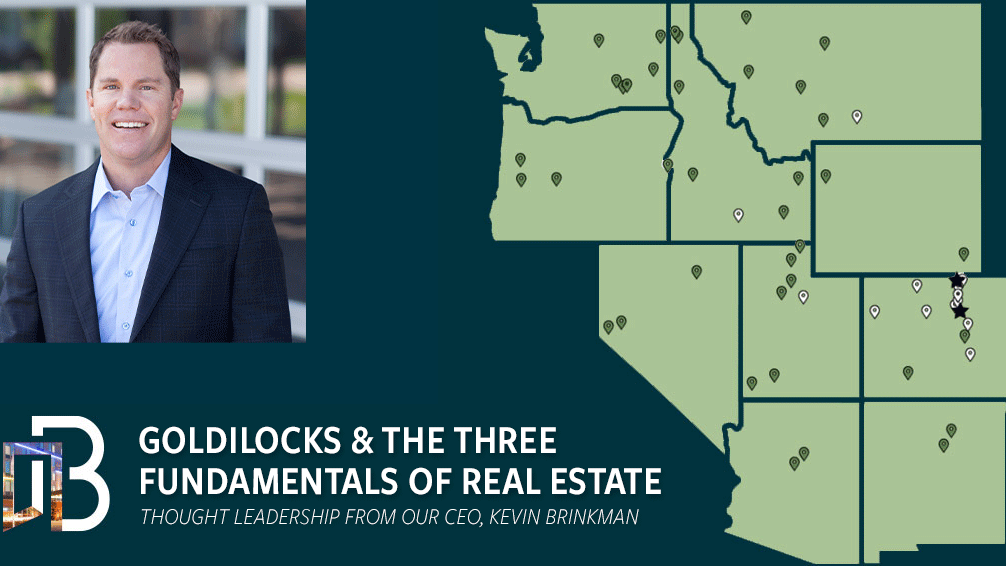

Location continues to be the guiding light of real estate investment. The 2020 Census Demographic Data Map highlights the country’s population growth while further justifying the price increases we are seeing across the mountain west.

This 2020 Census data showcases the highest population increases happening in states within the Intermountain West Region and the pandemic just further accelerated that trend. After being confined to their homes for nearly a year, people are moving to locations with easily accessible outdoor amenities and opportunities for increased living space.

Over the last year, you can see that nearly all the fastest growing markets are the smaller, suburban cities. The smaller suburbs of Arizona, Colorado, Utah, Idaho, and Washington have seen upwards of 20% increases in population while the larger cities such as Seattle, San Francisco, and Los Angeles all experienced three to ten percent decreases in population in the last year.

We see a similar trend with the Intermountain West Region experiencing the highest percent increases in employment over the last year.

To conclude with timing, the timing for investment is now. We are currently living in an opportunistic moment of time. The Federal Reserve’s quantitative easing measures will soon begin tapering, which will cause interest rates to rise. Federal Reserve Chairman Powell stated in his speech at the economic policy symposium late this summer that, “a gradual tapering process that concludes around the middle of next year is likely to be appropriate.” While we expect the increase in interest rates to happen gradually, it could be the cold porridge that concludes our Goldilocks Moment.

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.