Macro to Micro: How Inflation is Affecting Multifamily Real Estate Investment

As far back as 2019, real estate analysts began predicting pending inflation and increased construction costs impacting new development. This prediction materialized and accelerated as a result of the COVID-19 pandemic and, just as we were expecting a recalibration, the Ukraine/Russia conflict further heightened the impacts.

While real estate is generally considered a strong investment through all phases of the economic cycle, multifamily real estate investment, specifically, is weathering the current market shifts much better than other asset classes. The growth of the renter pool is vastly outpacing supply and new development will be priced at the top of the market due to increasing construction costs. Acquiring and adding resident-centric improvements to existing assets helps to ensure renters have high quality housing options with reasonable rents, a concept that’s more important than ever given the current economic climate.

The Bad News

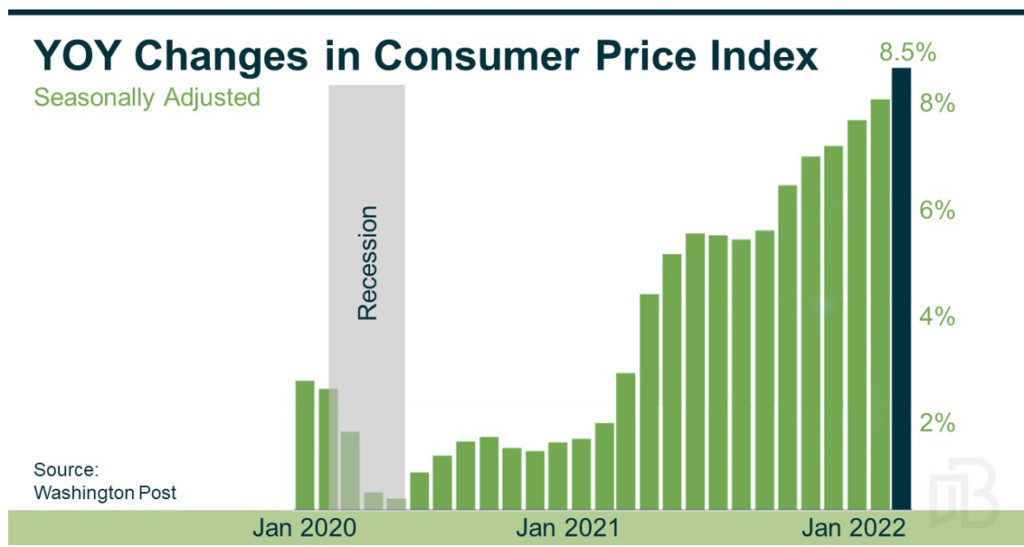

Looking at inflation from a more macro perspective, we’re seeing the CPI crest eight-and-a-half percent. This is a dramatic increase when you consider that year-over-year changes hovered between one and three percent consistently from 2012 to 2021. It’s likely that supply challenges will continue to drive up costs through at least 2023 due to several contributing factors, including China’s management of the pandemic, the Ukraine/Russia conflict, and labor shortages.

While effective at managing the pandemic spread, China’s “Zero COVID” policy translated to strict lockdowns that constrained workers and all but halted the entire supply chain. On the heels of these severe impacts, global food and energy markets took another big hit as a result of the Russia-Ukraine war.

These issues shined a blinding light on our country’s high level of supply chain concentration risk and began a shift to what the U.S. Secretary of the Treasury, Janet Yellen, termed “friend-shoring,” moving toward partnerships with like-minded, democratic countries. This change in globalization, albeit positive for long-term risk mitigation, will layer on additional consumer cost increases in the short to midterm.

In addition to supply chain issues, the workforce is short millions of workers. As it stands today, the U.S. labor market has more than two times the job openings than there are job seekers. Over two million late baby boomers have retired early due to health risks posed by the pandemic and the undesirable shift to remote work. We’ve seen more than a million less immigrants entering the country due to our current immigration policies, and unfortunately, close to a million COVID deaths. The remaining gap likely stems from people deciding to leave the workforce – whether to care for kids, or because stimulus funds, rent moratoriums, and increased home equity have made it financially viable to do so.

With all these factors at play, the Federal Reserve is continuing to raise interest rates to mitigate inflation. This has driven mortgage payments up 40% compared to this time last year, making home ownership unattainable for many Americans and driving demand for rental product.

The Good News

Amid the rising costs, the good news is that generally, the consumer is in excellent financial shape right now. Current leverage compared to the GDP is among the lowest on record. Jobs are plentiful and many companies are offering higher starting salaries and wage increases to recruit and retain top talent. In fact, wage growth is at an all-time high in the past year.

With the influx of stimulus money into the economy, there’s an excess of 1.5 trillion dollars in personal savings, up 14% since 2020. For the first time in 30 years, household cash is exceeding debt and consumer spending over the past few months is 12% higher than pre-COVID levels. All signs point to consumers, companies, and states still being flush with money generated in 2020 and 2021 to help weather these rising costs.

Impact on Real Estate

So, what does this mean for real estate? The Federal Reserve will continue to raise rates to slow the economy and reduce inflation. Wage increases, while higher than historical changes, won’t be able to keep up with housing costs.

Labor and material shortages will continue to drive up costs of new construction to the top of the market and out of the developer’s control. This further supports a shift to acquisitions where the basis is more competitive and costs can be fixed with interest rates locked for long-term debt.

Now that a lot of employees can work remote and receive the same salary, they’re moving from dense, urban markets to smaller communities. They’re searching for more space and access to the outdoors, less traffic, less crime, less political polarization, better schools, and overall higher quality-of-life combined with lower cost-of-living. This is causing outsized population growth in secondary markets throughout the mountain states.

This confluence of factors continues to reinforce multifamily assets in high-growth markets as a reliably strong investment.

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.