Multifamily Investment: A Beacon of Stability in the Current Landscape

As seen in Colorado Real Estate Journal>>

Written by: Kevin Brinkman, Co-Founder & CEO, Brinkman Real Estate

Many analysts plot us near the trough of the real estate cycle with new deliveries expected to peak in the near term and occupancy accelerating by end of year, hence the popular industry trope, “survive ‘til 25!” Although the difficulties of this phase of the cycle shouldn’t be understated, our perspective is that multifamily investment continues to be a beacon of stability in the current landscape, attracting investor interest regardless of the wider market uncertainties. When taken into context of incoming supply at a 40-year high, mild vacancy numbers and flat rent growth instills confidence that there are still opportunities on the horizon for strategic real estate investors.

Navigating Supply/Demand Dynamics

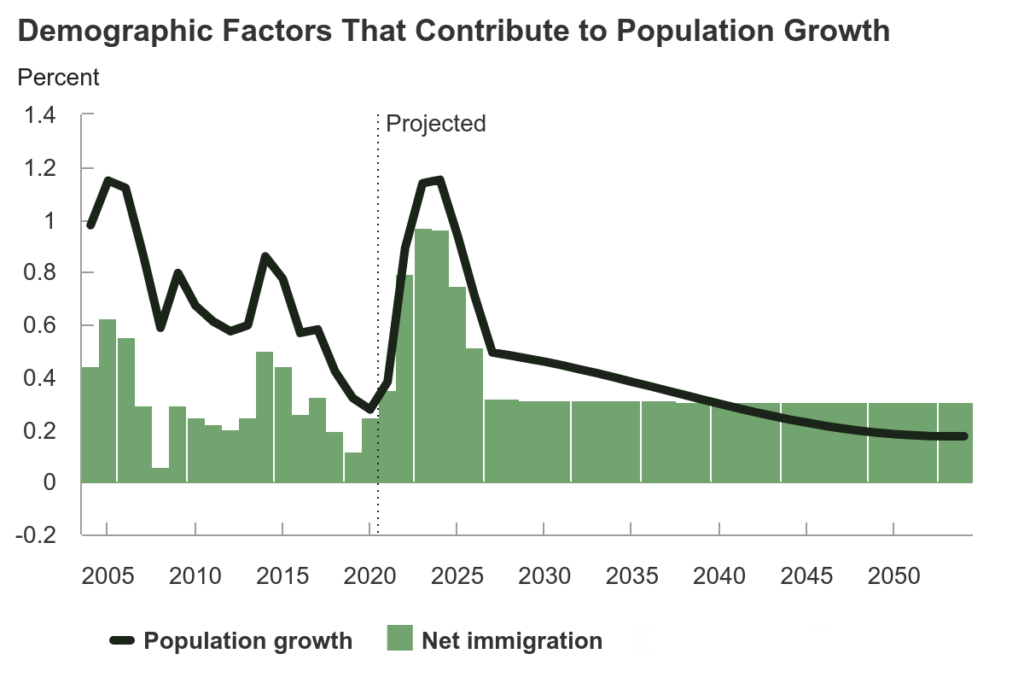

Despite industry uncertainties, the fundamental story for leasing at the national level remains surprisingly positive. Demand is normalizing, yes, but it’s far from cooling and is particularly strong in the mountain and sunbelt regions. Doomsday analysts peg these as the “oversupplied” markets, but they account for 70% of the absorption nationwide (Parsons, 2024). With a typical population growth trajectory, these new deliveries would be absorbed in 12-18 months, but immigration will vastly accelerate that absorption. The latest demographic outlook from the Congressional Budget Office estimates that net immigration in the next two years will be more than the total net immigration of the previous decade: 3.3 million in 2024, 2.6 million in 2025, and 1.8 million in 2026, compared to 900,000 annually 2010-2019 (Congressional Budget Office, 2024). With expectations of supply peaking and receding next year, combined with an uptick in projected population growth, this temporary slowdown from record highs shouldn’t paint a gloomy picture for the multifamily investment asset class.

Source: Congressional Budget Office. (2024, January 18). The Demographic Outlook: 2024 to 2054. https://www.cbo.gov/publication/59697

Occupancy and Vacancy

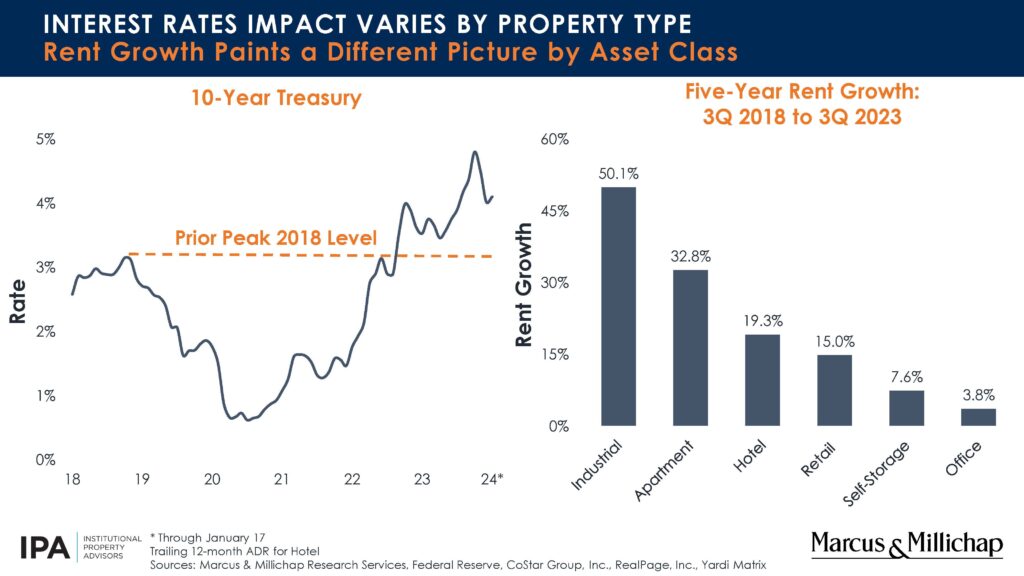

Much like the demand metric, occupancy and vacancy rates have shifted from the post-COVID boom but are still within historically normal ranges. Vacancy rates of multifamily investments have climbed but are significantly lower than other asset classes. Industrial products have grown in popularity among investors, but still don’t have the advantages of a diverse renter pool that multifamily inherently offers. Incomes, thankfully, are outpacing rent increases, effectively widening the demand funnel and easing affordability concerns. So, while challenges exist, the underlying story for leasing remains surprisingly steady.

Rent Growth

Although many markets have transitioned to a hyper supply environment, rent growth hasn’t plummeted like some expected it would. Rent growth is projected to remain within a narrow range of -2% to +2% (Parsons, 2024). This flat trajectory might seem concerning compared to the trends of the past few years but considering the substantial amount of supply currently being absorbed, it’s actually a testament to the sector’s underlying strength. We expect to see a strong rebound for multifamily investment rents as the supply-demand equation returns to equilibrium in Q4 2024/Q1 2025.

Source: Zandi, M. (2024, January 18). Cutting through Uncertainty: 2024 Economic and Commercial Real Estate Outlook [Webinar]. Marcus & Millichap. Institutional Property Advisors.

Identifying Deals in a Shifting Market

While we may no longer be “feasting” on available assets, it’s not a famine for those with laser-focused identification strategy. As we inch closer to the bottom of the cycle, the market is showing clear signs of stress, particularly among developers facing continued high construction costs and owners burdened by maturing debt. We also expect to see stress percolate through to the owners of “stabilized” assets that are on bridge or floating rate debt with rate cap maturities and expirations of extensions.

Lenders are quickly becoming less accommodating, and we expect this to drive a higher volume of off-market/stressed transaction volume in the coming year. With these confounding pressures comes cracks in the armor of seller pricing expectations. As debt remains at historically elevated levels, we expect cap rates will continue to expand to reflect the new market realities. This variety of circumstances will present prime opportunities for discerning investors, as motivated sellers might be willing to offer discounts to secure a quick exit.

Even though investors might feel pressed to “take what they can get,” focused market identification is more important than ever. As always, markets with strong fundamentals for real estate offer the most long-term stability and resilience, and those may not be the traditional core markets of years past. Secondary and tertiary markets have the biggest upside as the trend of remote work continues to play out. Identifying markets with outsized population growth, high quality of life drivers, diverse employment trends, and minimal incoming supply will ensure investments are shielded from temporary market fluctuations and positioned for sustained success.

Adapting to a New Lending Landscape

Among the biggest headwinds facing commercial investors is the current lending environment. Bank originations have cratered, with year-over-year multifamily bank originations down 49% and bank-specific originations down 73% during the same time period (Mortgage Bankers Association, 2023). This drop can be traced to a confluence of factors: a significant rise in interest rates, the recent failures of several major banks, and stricter lending regulations imposed by nervous regulators.

With traditional bank loans largely out of reach, borrowers are forced to get creative. Those with ample cash reserves can secure financing, but at the cost of hefty treasury commitments exceeding 20% of loan proceeds. Strong banking relationships also carry weight, offering access to more favorable terms and greater loan confidence. Multifamily investors find some solace in Fannie and Freddie, but even these government-backed institutions are tightening the purse strings due to higher interest rates and proceeds have been restricted by DSCR constraints versus LTV constraints from years past.

The current climate requires strategic maneuvering. Diversifying efforts across a wide range of banks, capital markets groups, and alternative financing sources is crucial for securing competitive terms. Leveraging existing banking relationships and forging new bonds with local banks and credit unions eager for new business are also viable paths. Ultimately, success depends on a multi-pronged approach.

Executing the Equity Raise

The final step of closing deals in this phase of the cycle is navigating the challenge of raising equity in an uncertain environment. We’ve had the most success with seasoned investors who remain enthusiastic about the long-term upside of multifamily compared to other vehicles. While deal volume has slowed, the current opportunities have stronger returns than we’ve seen in years. Reduced purchase prices and creative financing such as assuming current in-place debt ultimately provide attractive returns that continue to draw capital.

Beyond the return metrics, investors value trust in our commitment to transparency and open communication, as well as our elevated asset management platform. The strength of our partnerships instills confidence in our ability to steward investments and has led to referrals and the expansion of our investor list even during these challenging times.

While the commercial real estate landscape might be shifting, we remain confident in the stability of multifamily. Understanding the current supply/demand dynamics, navigating the financing challenges, and capitalizing on emerging opportunities are key to thriving in this environment.

References:

Parsons, J. (2024, January 10). U.S. Multifamily Outlook. RealPage. https://f.tlcollect.com/fr2/424/49134/RealPage_Multifamily_Update_CBRE_Boise_Jan_2024.pdf

Congressional Budget Office. (2024, January 18). The Demographic Outlook: 2024 to 2054. https://www.cbo.gov/publication/59697

Zandi, M. (2024, January 18). Cutting through Uncertainty: 2024 Economic and Commercial Real Estate Outlook [Webinar]. Marcus & Millichap. Institutional Property Advisors.

Mortgage Bankers Association. (2023, November 7). Quarterly Commercial/Multifamily Mortgage Bankers Originations Index. https://www.mba.org/news-and-research/research-and-economics/commercial-multifamily-research/quarterly-commercial-multifamily-mortgage-bankers-originations-index

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

April 30, 2025

The Brinkman Report – Episode 12

April 17, 2025

New Listening Bar Concept Opens at The Exchange

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.