At our recent investor summit, I polled the crowd about their predictions of the Fed’s stance on continued interest rate hikes. Needless to say, there weren’t many optimists in the crowd. The majority of our investors predicted we’d be celebrating the start of 2024 before the first fed fund rate cut, and some even thought it wouldn’t be until Q3 or Q4 of next year. I stand firmly with the former group, suspecting we’ll start to see cuts in nine to 12 months once the cracks in the economy really start to threaten our foundation.

We’re already seeing the first signs of these critical breaks in the economy within the banking sector. With the recent collapse of Silicon Valley Bank and others, there’s increased capital flow to larger banks, less loan payoffs, and additional scrutiny, significantly compressing credit availability from our banking system.

We predict the next shoe to drop will be the office sector, beginning with downtown towers. The work-from-home transition accelerated by the COVID-19 pandemic has left these large office buildings with historically high vacancies. Furthermore, there’s $500 billion in commercial loans maturing every year moving forward that will be forced to be refinanced in a tight capital markets environment with less favorable terms. Every savvy investor knows that portfolio diversification is a sound strategy, but when it comes to real estate investment during these unprecedented times, we remain confident in the multifamily sector as the most resilient.

There are an abundance of factors driving our focus in this asset class despite the capital markets environment. Topping the list are continued for-sale housing unaffordability, inherent protection against inflationary pressures with12-month leases, reduced tenant concentration risk with large rent rolls, stability of the government-sponsored debt markets, and a strong labor market. Even the high supply and market impacts tell an overall encouraging story for our investment thesis of acquiring in high-growth markets in the intermountain west. The boom of deliveries will likely hit larger metros harder than the secondary and tertiary markets, the high-barrier-to-entry MSAs that we focus on won’t experience the same level of overbuilding.

Regardless of uncertain economic conditions, people will always need a place to call home, and multifamily properties provide a relatively affordable alternative when compared to ownership. Various factors, including rising home prices, increasing interest rates, and stricter lending standards, make it more challenging for many individuals and families to afford a home. As a result, demand for rental housing remains strong, supporting the stability and performance of apartment communities.

Beyond the consideration of our hierarchy of needs, multifamily owners and operators can reset rents annually, setting rental rates to keep pace with inflation over time. This further positions multifamily real estate one of the most attractive options for investors looking for a stable income stream and protection against inflationary pressures. We have a 48-year history of rents exceeding inflation driving our firm confidence in this strategy.

Unlike the office, retail, industrial, and hospitality asset classes with a few large tenants, multifamily properties typically have a large rent roll, reducing the concentration risk associated with relying on a single tenant or a small number of tenants. This diversification mitigates the impact of tenant turnover or economic challenges faced by specific industries or companies.

Furthermore, the stability of the debt markets and the support of government-sponsored entities such as Freddie Mac and Fannie Mae play a significant role in the resilience of multifamily real estate. These entities provide liquidity and stability to the multifamily lending market, making it easier for investors to obtain financing for their acquisitions or refinancing needs. In fact, according to recent data, Freddie Mac and Fannie Mae account for 43% of the apartment loans, providing a stabilizing force to the asset class.

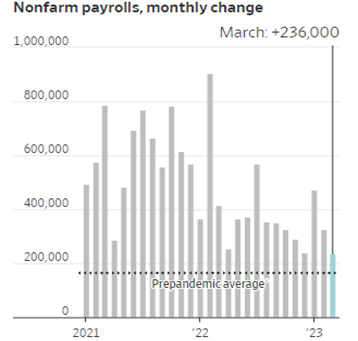

Another factor that drives the strength of the multifamily market is the overall health of the labor market. Despite economic fluctuations, the labor market has remained resilient, with low unemployment rates and steady job growth. There are still approximately 10 million jobs available in the U.S. and only five million job seekers. Additionally, the economy added 236,000 jobs in March 2023 alone.

Source: Labor Department (https://www.wsj.com/articles/march-jobs-report-unemployment-rate-economy-growth-2023-3338931f)

Focusing on the Intermountain West region, cities like Salt Lake City, Boise, and Bozeman have been experiencing rapid economic growth in recent years, leading to an even lower unemployment rate compared to national statistics. This data tells a story of a strong upcoming leasing season with rents increasing at historical averages, and renewals and collections both remaining strong.

One of the main areas of concern for multifamily investors right now is oversupply. In a recent article by CBRE, they predicted that while a shift in market fundamentals is imminent, it will be brief and not quite as dramatic as some might think. The constraints on the construction industry caused by the COVID-19 pandemic are just now lifting and under-construction unit counts are spiking to numbers equivalent to the 80s housing boom. When looking at long-run averages, vacancy is expected to increase only slightly above historic numbers and rent growth will remain in line with these long-term stats. Once the surge of new deliveries concludes next year, the market will likely stabilize and remain healthy going into the next cycle (“Looming multifamily”, 2023).

Although these dynamics deserve consideration, our investment strategy insulates us from the most severe impacts of this probable oversupply. We identify high-growth secondary and tertiary markets throughout the mountain states with relatively high barriers of entry due to low density zoning, elevated construction costs, NIMBYism, high cost of impact fees, and various other influences. These compounding factors serve to mitigate the impacts of overbuilding that may be experienced by the larger metro areas.

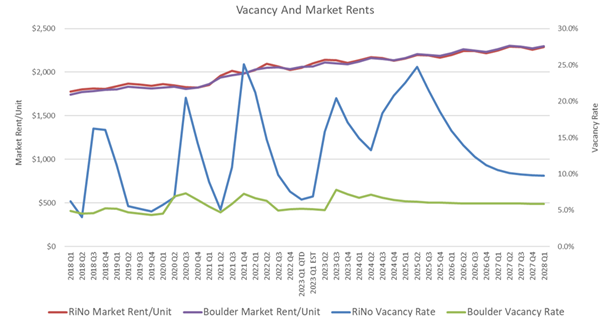

A good example of this contrast between sub-markets can be seen right here in our backyard when comparing Denver’s River North District (RiNo) to Boulder. RiNo has been a historically industrial area, allowing developers to obtain high-density entitlements. This seduces institutional investors to move in and build large properties where they can benefit from economies of scale. Boulder, on the other hand, has historically had more land use constraints that limit new development. Comparing the two sub-markets, rent growth per unit is almost identical, but vacancy rates diverge significantly. Whereas RiNo has seen huge swings seasonally, from five percent up to more than 25 percent vacancy, Boulder has stayed stable right around five percent vacancy rates.

Source: Connor Jones, Brinkman Real Estate

As we all continue to ride the wave of economic uncertainty, we remain committed to multifamily. The tried-and-true fundamentals of this asset class are ever present and, although we’re facing unfamiliar challenges, we are confident that multifamily is the most resilient real estate investment.

References

Cambon, S., and Timiraos, N. (2023). March jobs report shows hiring gradually cooling. The Wall Street Journal. https://www.wsj.com/articles/march-jobs-report-unemployment-rate-economy-growth-2023-3338931f

Looming multifamily oversupply likely will be short-lived. (2023, March 2). CBRE.com https://www.cbre.com/insights/briefs/looming-multifamily-oversupply-likely-will-be-short-lived

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

April 17, 2025

New Listening Bar Concept Opens at The Exchange

April 2, 2025

The Brinkman Report – Episode 11

April 2, 2025

Dan Metzger Receives NAIOP Award of Excellence

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.