Real Estate Investment in the Wildly Successful West

Americans have long ventured out west in search of expansive land, the lure of adventure, and the dream of prosperity for their families. Much like the homesteaders of the olden days, people are still moving westward for the improved quality-of-life and enhanced space that is such a limited resource within the most populated cities. As these populations continue to shift from traditional core markets to desirable locations throughout the Mountain States, we celebrate consistent success with our investments in the region.

Brinkman Real Estate began as a development and investment company working solely along the Front Range of Colorado. As our company matured, our strategy expanded geographically to include the entire Intermountain West Region with nearly $500 million in total projects and $330 million in assets currently under management. This strategy is rooted in the market and economic data that consistently show growth trajectories that outpace national averages.

Our return metrics in this region show a similar trend, with our investor internal rate of return topping 35% and equity multiple nearing 2.7x on average across our portfolio.

Intermountain West Growth Trends

The Intermountain West Region is known for its high quality-of-life and comparatively low cost of living. Offering residents an affordable and aspirational lifestyle powers the strong in-migration patterns occurring throughout the region. These heightened population shifts have accelerated over the last 18 months with coastal and traditional core markets experiencing a population exodus as long-time city dwellers move from the crowded confines of these densely populated metros to more desirable locations.

Our focus on scaling our multifamily footprint within these high-growth markets throughout the Intermountain West allows us to take advantage of these strong tailwinds and realize outsized return profiles to our investors.

As we continue to grow our footprint in these markets, we are taking a disciplined investment approach focused on assets exhibiting strong physical plants with significant management upside. As market cap rates continue to compress in the larger Metropolitan Statistical Areas (MSAs), there is an opportunity to realize outsized returns in these markets where rent growth continues to outpace that seen in the larger MSAs and pricing has not yet reached levels of the core markets. We’ve found the most success in building our portfolio with a mix of core plus and value-add multifamily assets, which provide two different return profiles for our investors to choose from.

Core Plus Multifamily

Core plus multifamily investments provide a low risk profile with stable cash flows. Assets in this category are often seen as an alternative to fixed income investments. We select vintages of 2000 or newer that need minor, if any, upgrades or renovations to minimize exposure to risk due to inflation of construction costs or capital expenditure surprises. With more predictable operating expenses and less need for saving cash for capital expenditures, cash flow begins quicker and experiences less volatility over the hold period.

These high-quality properties are fully occupied and present opportunities for light property improvements and management efficiencies to further optimize income and increase cash flows for our investors. Projected returns are upwards of 8-9% average cash-on-cash, 2.25-2.75x equity multiple, and 12-14% internal rate of return over the seven- to 10-year hold period.

Value-Add Multifamily

Value-add multifamily investments provide a moderate risk profile with higher potential returns. We take an opportunistic approach to assets in this category, implementing creative renovation and business plans to benefit from market opportunities.

Similar to development projects, value-add acquisitions experience more volatile cash flows due to unforeseen operational expenses, repairs, and capital expenditures. While we may not see immediate cash flow on these projects, there is a shorter hold period and a higher return on disposition due to heavy asset upgrades and value creation. Projected returns on these assets are greater than a 2x equity multiple and 14-17% internal rate of return over a three- to five-year hold period.

Rent Growth & Occupancy Metrics

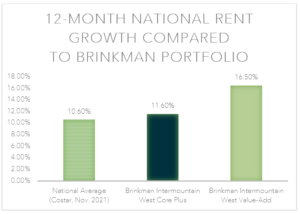

As the chart below displays, both core plus and value-add multifamily assets in the Intermountain West outperformed national rent growth averages last year. While the national average for rent growth according to Costar was 10.6%, our core plus rent growth was 11.6% and value-add rent growth was 16.5%.

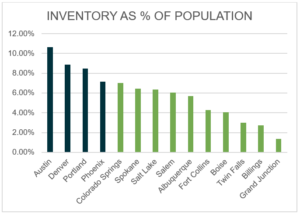

Our historical occupancy numbers further reinforce this strategy. Our average occupancy across all stabilized multifamily assets in our portfolio is 94%. With the continued population shifts to this region and lack of new supply, the inventory as a percent of population is historically low, further pushing occupancy and rent rates. The chart below shows the inventory as a percent of population in our target high-growth markets (green) as compared to the traditional core markets (blue).

The enticement of the West clearly hasn’t worn off over the last two centuries and these trends continue to have an upward trajectory. Population, rent growth, and inventory metrics point to the sustained strength of the real estate market throughout the Mountain States and the success of our portfolio.

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.