As seen in Western Real Estate Business

Written by: Brett Silverstein, Partner and Chief Acquisitions Officer, Brinkman Real Estate

With uncertainty looming large and terms like risk, crash, and recession swirling around the industry, it comes as no surprise that some investors are clinging to their cash reserves. But savvy investors go back to the fundamentals of the real estate cycle. While the economic conditions that influence the cycle are often different, such as the dot-com bubble, the Global Financial Crisis, and most recently, COVID, the predictability of the real estate cycle is consistent.

We remain laser-focused on doubling down to position ourselves to ride the currents of the market’s inevitable next chapter. Our acquisitions strategy is grounded in acquiring high-quality assets below replacement cost in intermountain west markets that exhibit strong fundamentals such as outsized rent growth, continued strong household formation patterns, and limited future supply growth.

Distress Leads to Discounts

Amidst the prevailing market turbulence, the acquisition of existing assets at a discount to the cost of building new ones becomes an even more compelling proposition. While replacement cost alone may not suffice as an investment metric, the combination of discounted prices and robust market fundamentals creates the secret sauce of sound investment decisions.

Housing is an essential good that is always in demand and has historically inflated over time. The foundational concept of “heads in beds” doesn’t change, regardless of unprecedented economic factors. The key is to seek out the hidden gems with a solid physical plant and value-add potential in a desirable market.

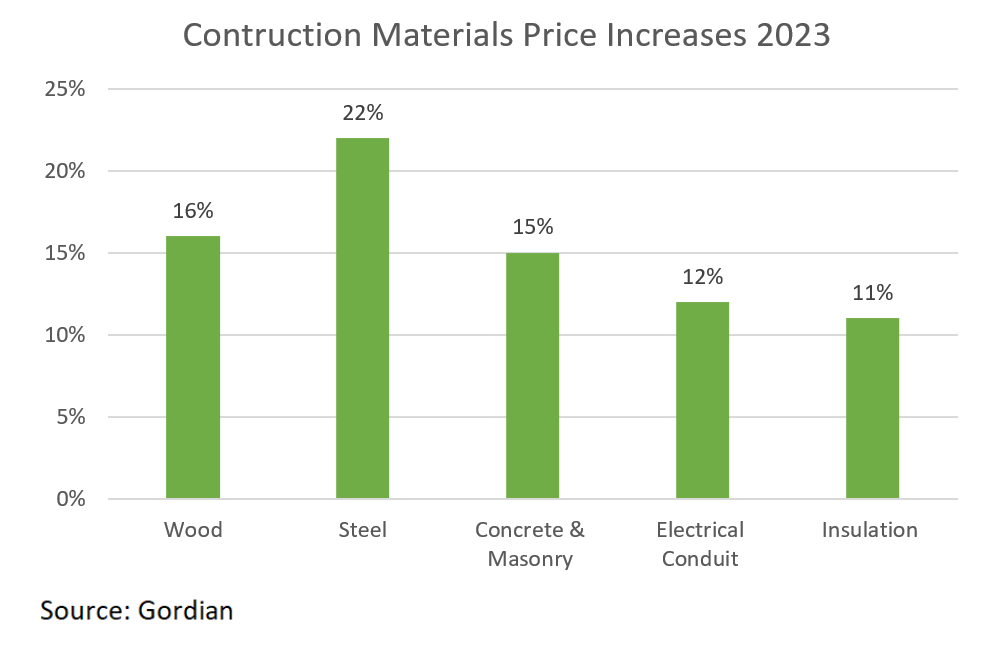

Construction Costs Keep Climbing

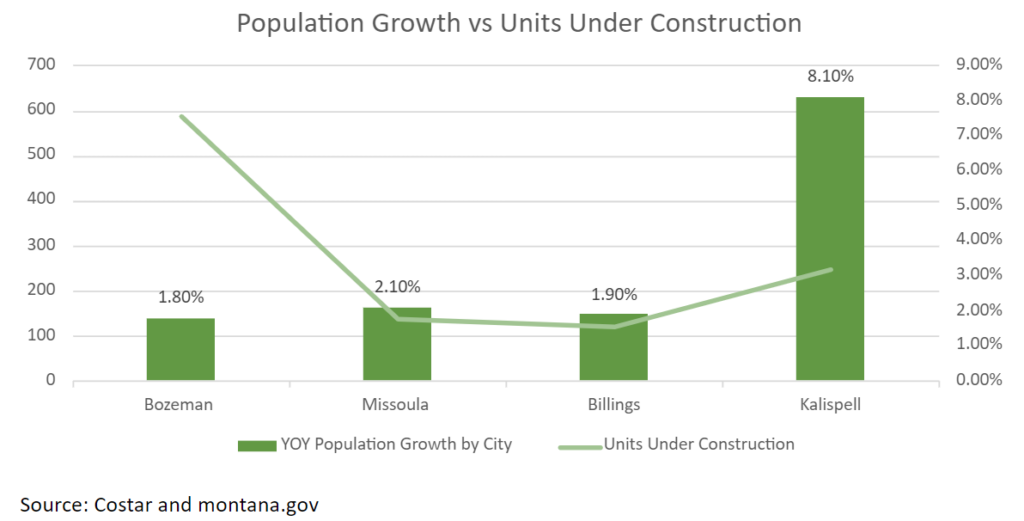

We firmly believe that construction costs will continue to inflate over time. While certain input costs, such as lumber, have plateaued or decreased recently, overall construction expenses remain on a significant upward trajectory. While some markets in the western states are seeing a surge in new deliveries in the short term, our strategy focuses on markets with unique supply dynamics that benefit investors. As an example, the Kalispell/Flathead County MSA has virtually no additional supply coming online in the near term. While other markets in our portfolio may have increased incoming supply, we expect this to level off or disappear in the next few years as construction costs rise and construction debt becomes more difficult to obtain.

An Eye on Market Fundamentals

An Eye on Market Fundamentals

We are continually assessing market and submarket fundamentals to understand the real-time changes in employment, inmigration statistics, household formation trends, housing affordability and upcoming housing supply (both for-rent and for-sale). This provides both a deep and a broad understanding of our target markets. The secondary intermountain west markets we’ve identified share many of the same characteristics, such as systemic undersupply of housing, high quality-of-life characteristics, and strong and diverse employment structures. The lack of new supply has led to overall housing unaffordability and a growing renter base. This underscores the need for quality housing with sophisticated management. These communities have experienced strong population growth in recent years due to the work-from-home trend, drawing new resident in with their outdoor access and relative affordability compared to larger metros. As long as these dynamics remain at play, we believe our markets will remain resilient through the rest of the “lazy” W-shaped recovery we’re all bracing for.

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

April 30, 2025

The Brinkman Report – Episode 12

April 17, 2025

New Listening Bar Concept Opens at The Exchange

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.