Soft Landings and Hard Truths: A Forecast for the Year Ahead

As seen in Colorado Real Estate Journal>>

Written by: Kevin Brinkman, Co-Founder & CEO, Brinkman Real Estate

Economists are weighing the outlook for 2025 amid shifting interest rates, evolving inflation targets, and changing labor market conditions. From the probability of a soft landing to concerns over potential black swan events, there’s a range of feasible scenarios for the coming year, and only time will tell. In a recent episode of The Brinkman Report, I welcomed Denver-based attorney Russell Hedman and entrepreneur Sasha Stern, and we discussed how these evolving economic conditions could impact the real estate sector. Drawing on our unique perspectives, we identified the many factors at play and explored different ways of interpreting them as we forecast the coming year.

Interest Rate & GDP Outlook

My guests had differing perspectives on the direction of the 10-year Treasury yield by late 2025, and that seems in line with general market sentiment. One side argued that the 10-year Treasury yield could fall below 4% by 2025, mainly because staying above that level would put too much pressure on the economy (especially real estate markets) and force policymakers to step in with relief measures. This softer labor market could encourage multiple Federal Reserve rate cuts, or even quantitative easing, if GDP growth remained strong but employment growth weakened, ultimately keeping inflation near current levels. On the other side, there’s caution that persistent inflation could compel the central bank to hold the overnight rate steady, resulting in no cuts this year. Sustained inflation pressures and potential labor market constraints—especially in areas impacted by immigration policies and tariffs—might keep rate reductions off the table.

Real Estate Implications

A host of macroeconomic variables could ripple through the real estate market this year. Higher interest rates have already sidelined a lot of commercial deals, while ongoing uncertainty about future interest rates has deterred aggressive acquisitions. If the Federal Reserve initiates even modest rate cuts this year, we may see an increase in new development, but overall cost issues could offset these benefits. High tariffs on imported materials, alongside tighter immigration policies, could inflate construction labor costs and limit new construction starts even further.

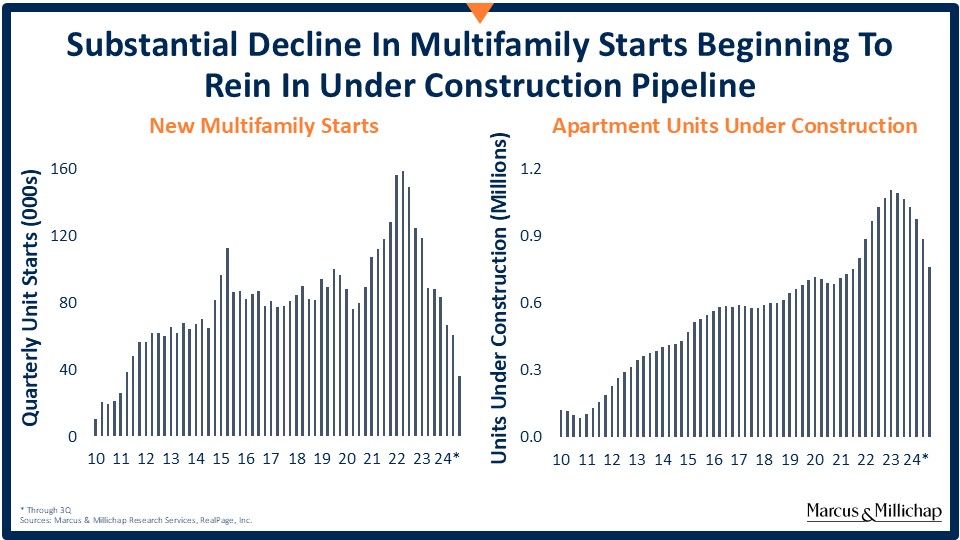

Secondary and tertiary markets, which benefited from strong in-migration trends during and after the pandemic, have managed to absorb much of the new supply more readily. These regions continue to see healthy demand for multifamily properties, partly mitigating any negative impact from the historical highs of new product deliveries. In contrast, high-density urban areas are still completing projects approved several years ago and taking longer to deliver because of the size and scope of the projects. These areas expect a sharp drop in starts for at least the next two years as financing challenges and cost pressures persist.

Sources: Marcus & Millichap Research Services, RealPage, Inc

This tapering of new supply, coupled with robust demand, will start to drive rents higher once again, which in turn is reigniting investor interest. With transactional activity slower in recent years, a significant amount of capital sits on the sidelines, poised to return to the market as soon as conditions stabilize. Despite the near-term hurdles of elevated rates and building costs, core fundamentals—such as solid population growth and pent-up capital—provide a supportive backdrop. As liquidity conditions and capital flows become more predictable, the constrained pipeline will likely keep rental rates and property valuations on an upward trajectory, suggesting a recalibration that could offer more stability than the market has seen in several years.

Potential Black Swan

While most projections revolve around moderate growth scenarios, we’ve seen in the last few years that we’re not immune from unpredictable factors that could disrupt the economy. A “black swan” event, by definition, refers to an extremely rare and unpredictable occurrence that carries a severe impact. Moving into 2025, one such event could unfold in the insurance sector. Significant insurance market failures triggered by catastrophic events—such as wildfires or hurricanes—could prompt large carriers to exit those markets. This could increase property ownership costs and shrink mortgage availability, thereby having a significant impact on the real estate market.

Geopolitical Environment

Ongoing conflicts abroad and the possibility of new unrest in other regions could have significant economic impacts. We may have seen temporary gains from supply disruptions in foreign markets in recent years, but a major escalation could reshape global investment flows and encourage a shift toward safer assets, dampening capital available for real estate.

Shifting Labor Dynamics and AI

Opinions vary widely in the market on the potential for artificial intelligence to rapidly transform employment, specifically white-collar jobs. Some experts predict AI-driven efficiencies could soon displace many corporate roles, keeping inflation in check by slowing wage growth. Others, however, argue that AI might serve more as a tool than a total replacement, especially in fields requiring negotiation and oversight.

Regarding real estate, greater AI adoption could streamline development and property management, though a shrinkage in office-based employment may eventually reduce demand for commercial space. A downturn in office occupancy could lower downtown property values, while fueling growth in suburban or home-based alternatives.

Looking Ahead

Although it might be anybody’s guess at this early point in the year, my predictions for 2025 include GDP growth above 3%, inflation closing in on the Fed’s target of 2% and the 10-year treasury in the 4 to 4.5% range. For real estate stakeholders, the key takeaway is to stay vigilant about changing construction costs, labor availability, and the interplay between monetary policy and market confidence. With interest rates, global tensions, and potential black swans all in the mix, I’m still cautiously optimistic for the real estate industry in 2025 and beyond.

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.