Riding the Wave of Rate Cuts: What the September Fed Decision Means for Investors

As seen in Colorado Real Estate Journal>>

Written by: Kevin Brinkman, Co-Founder & CEO, Brinkman Real Estate

By Kevin Brinkman, Founder & CEO, Brinkman Real Estate

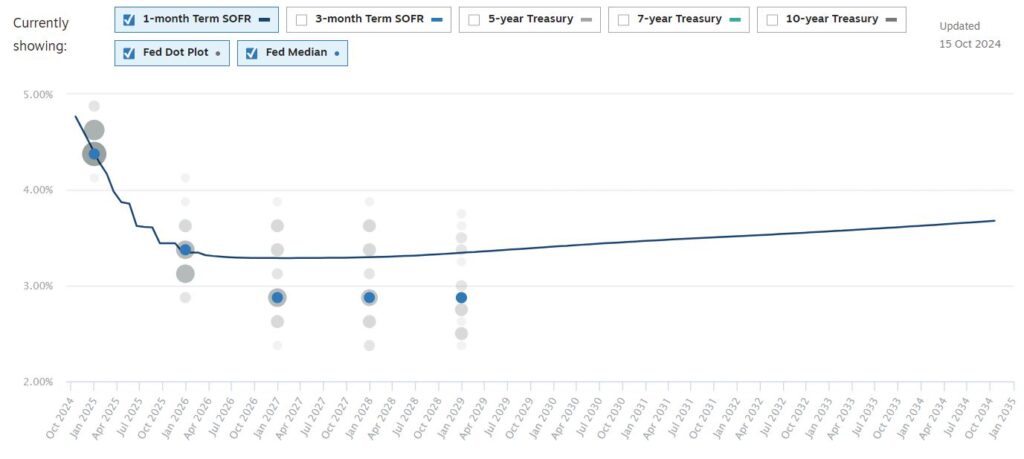

The Federal Reserve’s 50 basis point (bps) rate cut on September 18, 2024, marked the end of a 30-month tightening cycle and the start of a new chapter for investors. After an extended period of rising interest rates, the Fed has pivoted, setting the stage for the next phase in the market. While the precise pace of future rate cuts and the movement of the longer end of the yield curve remain unclear, the trend toward lower interest rates on the short end of the curve seems certain.

Source: Chatham Financial; https://www.chathamfinancial.com/technology/us-forward-curves;

For many investors, this shift is a welcome relief. As confidence grows that property values have already hit bottom, buyers are re-entering the market, eager to capitalize on forthcoming lower borrowing costs. The “Great Tightening” may be over, but the next challenge is navigating the opportunities that come with this new phase.

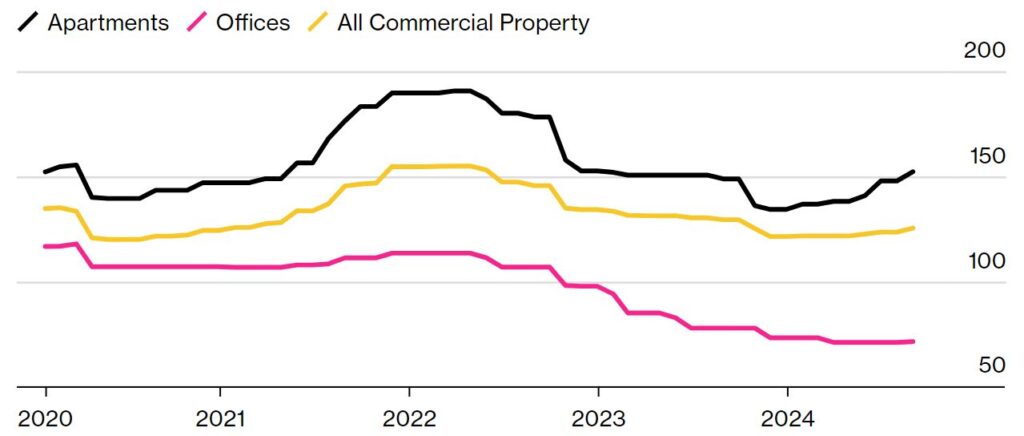

The Impact on Real Estate Pricing

With the Federal Reserve’s rate cut, a critical shift is happening—investors are beginning to reassess what they’re willing to pay for properties. Lower interest rates enable buyers to pay more for assets and achieve the desired return profile. This is particularly true when it comes to the re-emergence of positive financial leverage. In this environment, positive financial leverage will become a pivotal driver of increased transaction volume in 2025.

Property prices, which had softened during the last two years, are now poised for a rebound. As capital becomes cheaper, we will see a renewed ability for investors to make the numbers work, reigniting the market.

Source: Bloomberg; https://www.bloomberg.com/news/articles/2024-09-24/commercial-real-estate-activity-picks-up-with-buyers-lenders-returning;

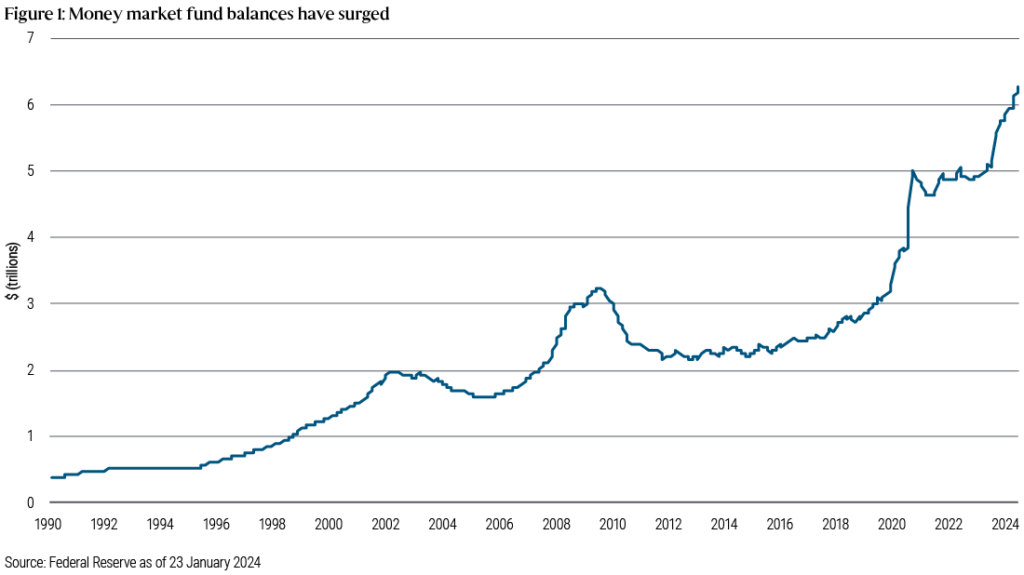

Capital Waiting on the Sidelines

The U.S. currently has more available capital than almost any time in history, and this liquidity will play a significant role in shaping the next few years. Money market fund balances are soaring to unprecedented levels, stock markets continue to bounce around record highs and U.S. Treasuries have accumulated to unmatched levels. Even gold, traditionally a safe haven in uncertain times, is near historic highs.

Source: Pimco; https://www.pimco.com.sg/en-sg/insights/economic-and-market-commentary/pimco-perspectives/the-cost-of-cash-a-6-trillion-question/;

While much of this capital has been parked in safe, short-term instruments, the dynamics are shifting. As the fed funds rate falls and money market yields shrink closer to 3%, we’ll see trillions of dollars moving out of low-yield accounts into investments that offer greater returns. Real estate is well-positioned to capture a part of this influx of capital, especially as investors look for opportunities that align with their appetite for risk and return.

“Stay Alive Until 2025” Becomes “Stay Alive Until 3.5”

There’s a phrase circulating among investors: “Stay alive until 2025.” But I’d argue this phrase should be updated to “Stay alive until 3.5,” a reference to the anticipated drop in money market yields to the mid-3% range by sometime in 2025. When this happens, the flow of capital will change dramatically, as investors who are currently content with the safety of low-risk investments will once again chase higher returns.

This influx of capital into real estate will coincide with a gradual absorption of new multifamily supply. It’s important to note that while we’ll continue absorbing new development throughout 2025, it will likely take a couple years of rent growth before we see a major shift in development activity resulting in low new supply in 2026-2027

Looking Ahead: The Election and Market Stability

By 2025, the election will be behind us, and assuming a divided government, we will likely avoid any major legislative changes that could disrupt the market. This will remove a significant layer of uncertainty and allow both investors and developers to take risks again with a clearer sense of the political landscape. With the combination of lower interest rates and a stable political environment, I believe we’ll witness a strong resurgence in the real estate market.

Riding the Next Wave

The September rate cut is a clear signal that we’re entering a new phase in the market, and it’s a shift that investors should be prepared for. As rates continue to fall in 2025 and capital becomes cheaper, we’ll see a surge in real estate transactions, driven by improved financial leverage and the availability of capital.

We may still have some turbulence ahead, particularly as we absorb new supply and navigate the political landscape. But the current is turning, and for those who are ready, the next wave of opportunity is here. Now is the time to position for growth as the market begins to move in a new direction.

SHARE THIS POST

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.