As seen in Colorado Real Estate Journal

Written by: Kevin Brinkman, Co-Founder & CEO, Brinkman Real Estate

We are entering the first inning of the multifamily housing buying opportunity we have been waiting for. The historic multifamily supply coupled with tightening capital markets are creating motivated sellers needing to liquidate and harvest capital. We are already seeing an uptick in opportunities and expect the next six to 12 months to bring a flurry of sellers to the market. In this time of cautious optimism, I’m reminded of Warren Buffet’s advice to, “be fearful when others are greedy and greedy when others are fearful” and its timely relevance for multifamily investors. For those with the conviction to push through the headwinds, the upside of uncertainty is that we could be moving into the best buying opportunity since the Great Recession.

Shaking the Apple Tree

If we zoom out and look at this from a macro perspective, we believe the economy will dramatically slow down through Q1 and Q2 of 2024, even if we don’t go into a full recession. There’s an array of headwinds that will likely slow economic activity next year. While that creates difficulty in many industries, it may actually “shake the apple tree” for opportunistic real estate investors willing to get creative and buy in high-growth secondary markets. We’re keeping a close eye on the confounding factors creating a volatile environment and looking for the silver lining within these headwinds.

Pushing Through the Headwinds

Geopolitical tensions: The war in Ukraine and the ongoing instability in the Middle East pose a risk to the global economy and could lead to higher energy prices and supply chain disruptions.

Global economic slowdown: A recession in China or Europe would have a negative impact on the global economy and could lead to job losses and lower demand for U.S. goods and services.

Capital markets: Although we think we’re at the peak of the Federal Reserve tightening cycle, the upward pressure on borrowing costs is making it hard to pencil deals.

Inflation: Despite the Fed’s aggressive interest rate hikes to mitigate inflation, it still remains higher than the goal of two percent. The tight labor market further contributes to inflation with employers paying higher salaries to keep or recruit talent.

Politics: The looming government shutdown, federal debt levels, and general political volatility, have created a challenging environment for businesses and investors.

While these headwinds can’t be understated, we still believe multifamily investment is the best place to put capital in this phase of the cycle. The key is to identify markets that continue to have strong demand, high barriers to entry, and outsized home value growth. Our focus is on the secondary markets throughout the Intermountain West region that continue to exhibit these strong fundamentals.

Demand is Still Strong

One of the key factors driving demand for multifamily housing throughout the mountain states is the tight labor market, with an estimated 100 jobs open for only 75 workers to fill them. This labor shortage serves to drive up housing costs and, along with rising mortgage rates, makes homeownership unattainable, encouraging tenants to stay put in rental communities. Despite the impact on inflation, we’re still seeing very low delinquencies and collection losses, signifying that tenants are financially stable and continue to afford their rent in these markets. Although we can all agree that we’re in a volatile real estate market overall, these factors indicate stability and instill confidence in our multifamily-focused acquisitions strategy.

Supply Challenges

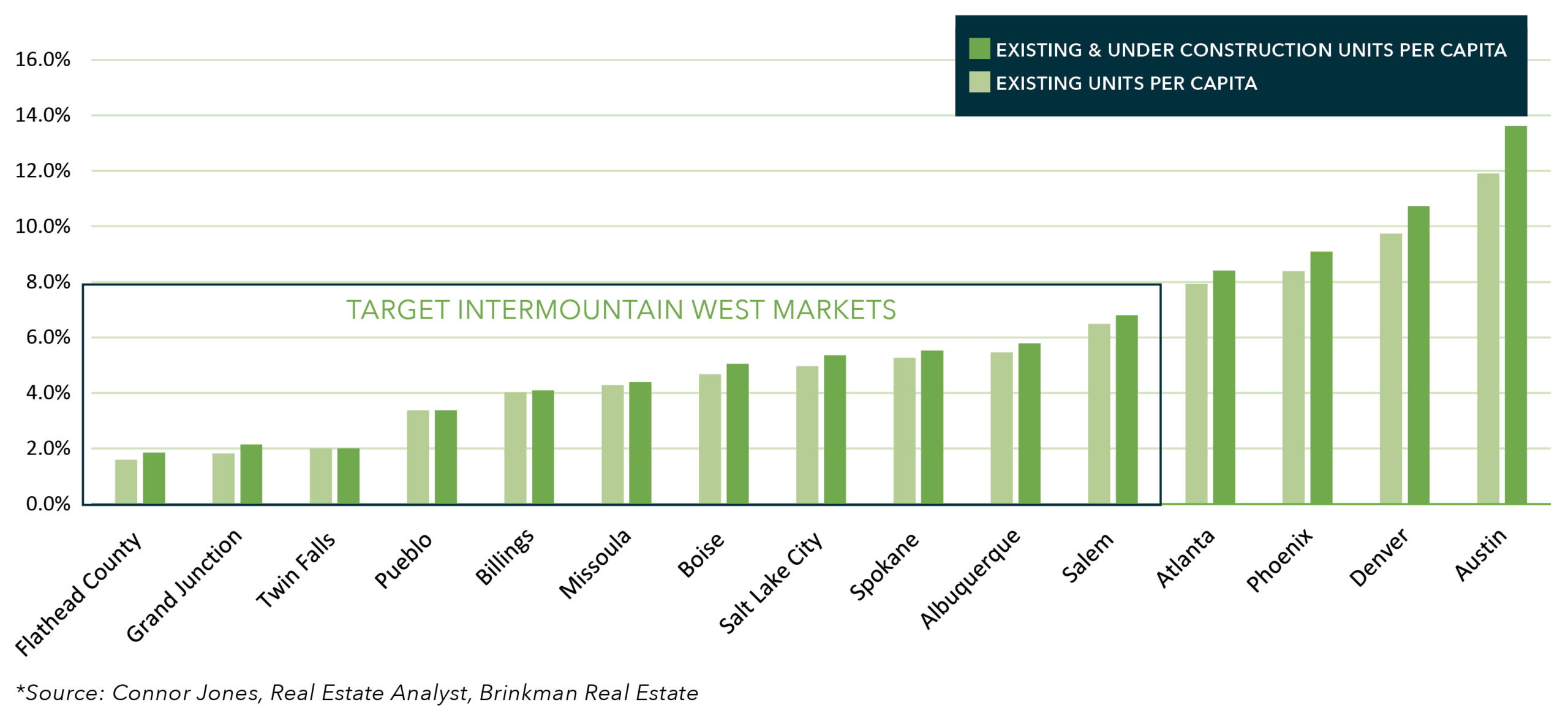

The historic amount of apartment supply being delivered over the next year will no doubt increase vacancy and impede rent growth in many markets. With that in mind, we continue to believe firmly that the mountain states are home to secondary markets with the highest likelihood of rent and occupancy stability. Originally a result of the post-COVID remote work transition, these markets have seen sustained population growth as people move from larger metros in search of space, quality-of-life, and relative affordability. Regardless of this in-migration pushing the supply imbalance, there’s less construction in these markets due to the high barriers of entry.

The mountainous landscapes of these cities leave little land availability, making it difficult and expensive to build. Additionally, there are often stringent zoning restrictions, climbing construction costs, and rampant NIMBYism which all serve as further checks against overdevelopment. This cocktail of factors, combined with the region’s allure as a desirable place to live, further bolsters the sustainability of real estate investments.

Is Now the Time to be Greedy?

For the firms that can be bold and nimble with deal structures, we think now is the time to buy. With interest rates at or near the peak and the confounding pressures on the economy, motivated sellers are starting to emerge. With limited refinance options, those sellers on a time crunch or in a cash deficit will likely be willing to sell at a much lower basis. Now is when shrewd investors can seize these opportunities that will ultimately lead to exceptional gains.

Although there are very strong headwinds to face, the supply and demand fundamentals remain strong if you choose your markets wisely. For investors willing to leave no stone unturned and “be greedy when others are fearful,” this phase of the real estate cycle could present once-in-a-lifetime investment opportunities.

Interested in learning more about current opportunities? Contact our investor relations team >>

SHARE THIS POST

NEWSLETTER SIGN UP

RECENT NEWS

A PROVEN TRACK RECORD OF INVESTMENT

UNION POINTE

Longmont, CO

This 256-unit multi-family project traded for a record price in the Longmont market.

EVERSAGE APARTMENTS

Payson, UT

Our team executed unprecedented deal terms on this 168-unit complex located within the fastest-growing region of the Greater Salt Lake Area.

KING WEST ONE

Billings, MT

This 128-unit acquisition maximizes on the forward momentum of the Billings market and the operational upside of the property.

Comprehensive Real Estate Services

We have deep expertise in all aspects of real estate investment, from acquisition to asset management and everything in between.